Prosper company overview

BAC Medical Financing (BACMF)

Connecting People Who Need Money With Those Who Have Money To Invest!

BAC Medical Financing (BACMF) has partnered with Prosper, the world's largest peer-to-peer lending service, to be able to offer special financing for medical / dental procedures and treatments to BAC Medical Tourism's patients (performed in Costa Rica, Puerto Rico and Panama), as well as, the general public through BACMF (performed anywhere in the United States). Prosper, working with BACMF, is able to provide the lowest medical loan rates anywhere in the financing industry.

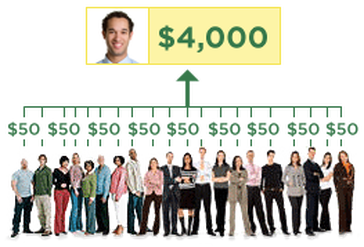

In peer-to-peer lending, borrowers post loan requests on Prosper's website, via the advertisement link located at the bottom of this page, and these loans are invested in by many lenders. Thus, a person borrowing $10,000, may have dozens and dozens of lenders investing in the loan. Prosper acts as the platform, and collect and distribute all the money, though the loans on their site.

Benefits of Loans for the Borrower:

How Long Does the Borrowing Process Take?

Here's How it Works:

BAC Medical Financing (BACMF) has partnered with Prosper, the world's largest peer-to-peer lending service, to be able to offer special financing for medical / dental procedures and treatments to BAC Medical Tourism's patients (performed in Costa Rica, Puerto Rico and Panama), as well as, the general public through BACMF (performed anywhere in the United States). Prosper, working with BACMF, is able to provide the lowest medical loan rates anywhere in the financing industry.

In peer-to-peer lending, borrowers post loan requests on Prosper's website, via the advertisement link located at the bottom of this page, and these loans are invested in by many lenders. Thus, a person borrowing $10,000, may have dozens and dozens of lenders investing in the loan. Prosper acts as the platform, and collect and distribute all the money, though the loans on their site.

Benefits of Loans for the Borrower:

- Application is online and takes less than five minutes

- Fixed loan rates from 6.73% to 35.84% APR (lower than any other financing for medical loans)

- Loans are unsecured. No collateral required

- Fixed rate -- Interest rate never changes for life of loan

- Multi-year terms

- Easy monthly payments

- Loan sizes from $2,000 to $35,000

- No prepayment penalties

- No upfront fees - Origination fees depend on credit rating of borrower and are taken from the loan proceeds

How Long Does the Borrowing Process Take?

- Five minutes to get pre-qualified online

- 15 minutes to draft the loan listing

- One day to two weeks for lenders to fully commit to the loan

- 24 hours after loan is fully committed and verification documents are received, the patient receives funds

- Some patients get their funds within three to four of first application

- The average patient borrower has the funds deposited directly into their account within eight days of submitting their application

Here's How it Works:

- Borrowers choose a loan amount, purpose and post a loan listing.

- Investors review loan listings and invest in listings that meet their criteria.

- Once the process is complete, borrowers make fixed monthly payments and investors receive a portion of those payments directly to their Prosper account.

Borrow Money

APR starting at:

APR starting at:

Fixed rates from 6.73% to 35.36% APR for borrowers:

- Provide basic application information

- Post your customized loan listing

- Watch Prosper investors invest in your loan

- Get your money

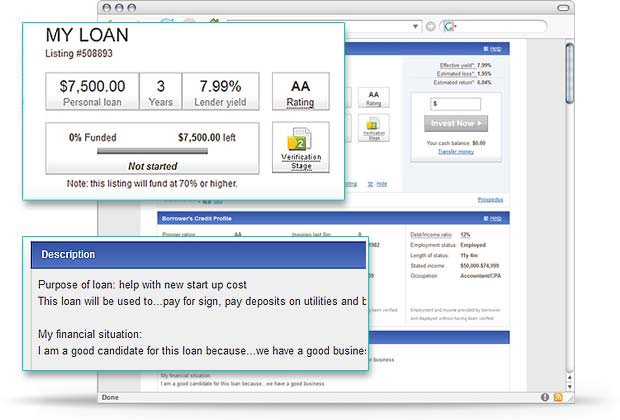

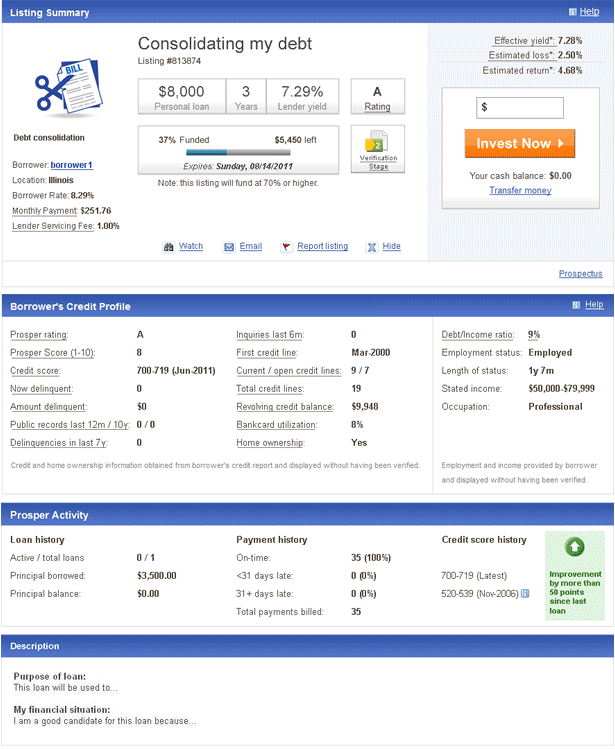

Step One: Create Your Loan Listing

Creating a loan listing on Prosper is easy and only takes a few minutes.

You will be asked to fill out some personal information, which will help them to give you the best rate and loan terms possible and protect you and others against fraud. Prosper will check your identity and obtain your credit score. (This will not affect your current credit score.)

Prosper will then assign your loan listing a Prosper Rating, which is based on your credit score from a credit bureau (Experian) and another score developed internally by Prosper. Your loan's interest rate will be based on your Prosper Rating.

Now the fun begins: You create a custom loan listing by giving your listing a title and adding a description of your loan purpose and your financial situation.

What's the difference between a listing and a loan?

A listing is your request for a loan. Your listing will be displayed for investors to view. You will receive a loan after your listing is funded and your information has passed Prosper's verification process, as needed.

Asking your friends and family to invest in your listing and give you a recommendation will increase your chances of having your listing fully funded.

Creating a loan listing on Prosper is easy and only takes a few minutes.

You will be asked to fill out some personal information, which will help them to give you the best rate and loan terms possible and protect you and others against fraud. Prosper will check your identity and obtain your credit score. (This will not affect your current credit score.)

Prosper will then assign your loan listing a Prosper Rating, which is based on your credit score from a credit bureau (Experian) and another score developed internally by Prosper. Your loan's interest rate will be based on your Prosper Rating.

Now the fun begins: You create a custom loan listing by giving your listing a title and adding a description of your loan purpose and your financial situation.

What's the difference between a listing and a loan?

A listing is your request for a loan. Your listing will be displayed for investors to view. You will receive a loan after your listing is funded and your information has passed Prosper's verification process, as needed.

Asking your friends and family to invest in your listing and give you a recommendation will increase your chances of having your listing fully funded.

Step Two: Investors Commit Funds to Your Loan

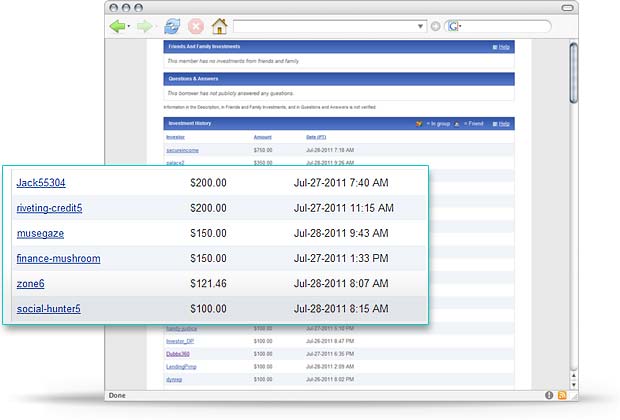

Once your listing is active on Prosper, lenders will be able to view and invest in your listing. At any time in this funding process, you can see the progress of your loan's funding.

The listing will stay active until either it is fully funded or the 14 day listing period ends. If it does not receive at least the minimum required level of funding within the 14-day period, no loan will be made. If you want to try again, you do so by creating a new listing.

Increase your chances and get your money faster

Submit all requested information and documents as soon as possible. Keep an eye on your listing's Verification Stage icons, which tell you and potential investors how far along your loan application is in the verification process. The higher the Verification Stage, the more attractive your listing is to potential investors. Loans that reach Verification Stage 3 are much more likely to originate.

Once your listing is active on Prosper, lenders will be able to view and invest in your listing. At any time in this funding process, you can see the progress of your loan's funding.

The listing will stay active until either it is fully funded or the 14 day listing period ends. If it does not receive at least the minimum required level of funding within the 14-day period, no loan will be made. If you want to try again, you do so by creating a new listing.

Increase your chances and get your money faster

Submit all requested information and documents as soon as possible. Keep an eye on your listing's Verification Stage icons, which tell you and potential investors how far along your loan application is in the verification process. The higher the Verification Stage, the more attractive your listing is to potential investors. Loans that reach Verification Stage 3 are much more likely to originate.

Step Three: Receive Your Money!

Once your listing is fully funded, the funds will be deposited directly into your bank account within a few days.

Prosper may conduct a final identity verification before funds are released.

Step Four: Make Monthly Payments

Prosper will make monthly automatic withdrawals from your bank account in the amount of your agreed-upon monthly loan payment.

If you choose, you may make an optional additional loan payment or pay off your loan early without penalty. If you make your payment with a paper check, manual check fees will apply.

Once your listing is fully funded, the funds will be deposited directly into your bank account within a few days.

Prosper may conduct a final identity verification before funds are released.

Step Four: Make Monthly Payments

Prosper will make monthly automatic withdrawals from your bank account in the amount of your agreed-upon monthly loan payment.

If you choose, you may make an optional additional loan payment or pay off your loan early without penalty. If you make your payment with a paper check, manual check fees will apply.