It’s “a truly astonishing graph,” according to Derek Thompson at The Atlantic. “I knew health care had been the most important driver of national employment over the last few years, but I had never seen the case made so starkly.”

Thompson wasn’t alone in his surprise. (Hopefully, readers of The Health Care Blog would be less astonished.) But lost within the reaction—and even mostly overlooked within the industry—is that not all health care jobs are growing, or at least not growing at the same pace.

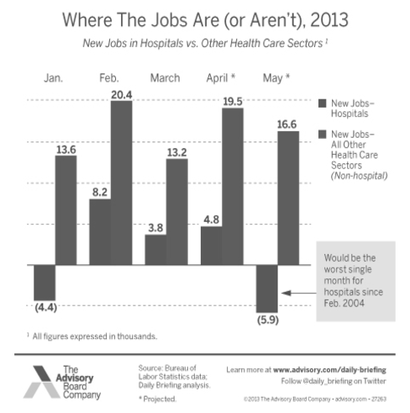

Take a look at the following chart. It resembles the Brookings data, with one major change: The hospital employment curve has been separated from all other health care jobs growth.

Notice how hospital employment essentially flatlined across 2009—a hard year for the sector, which was still insulated compared to the rest of the economy. But many organizations pared back on staff and sought to cut non-essential services to survive the Great Recession.

And while sector employment began to rebound in 2010, roughly in line with other industries, there’s been a surprising blip this year. Hospitals shed jobs in January, and according to the Bureau of Labor Statistics’ estimates, hospitals also lost nearly 6,000 jobs in May—on paper, the worst single month for the sector since February 2004.

It’s possible that when the new jobs report comes out on Friday, May’s number will be revised up. But the trend is unmistakable: Hospital job growth, which used to parallel the rest of the health care industry, is now following a slower curve.

Why the sector-wide slowdown? I spoke with several health economists and labor experts, and here are a few leading hypotheses.

Hypothesis: It’s because fewer people are seeking care in hospitals.

There’s increasing evidence that the long-anticipated care shift away from the inpatient setting and to less costly outpatient settings is finally underway.

For example, Martin Gaynor, an economist at Carnegie Mellon, cites the Health Care Cost Institute‘s recent study on how inpatient utilization is declining for the privately insured. And Fitch Ratings last week issued a report on the changing patterns in care delivery, ticking off the various reasons why hospital volumes are falling: patients paying for a greater share of their care, federal policies that reduce readmissions, and insurers incenting care in lower-cost settings, among other factors.

Hypothesis: Wary hospitals aren’t eager to hire.

Partly because of their weak volumes—and partly because of outstanding questions around the sequester, other potential reimbursement cuts, and broader economic concerns—the hospital labor market is basically in a “holding pattern,” according to John Workman, practice manager of the HR Investment Center and my colleague at the Advisory Board.

Workman points to his latest benchmarking data on hospital turnover and vacancy rates; while both indicators showed signs of a rebound through 2012, the rates have since been flat as hospital executives have held pat.

Hypothesis: It’s the effect of Obamacare.

The Affordable Care Act has added new financial pressures for hospitals, such as a push toward new payment models that don’t reward them for doing more procedures. But while this theory gets advanced when some hospitals announce major layoffs, the health law tends to be more convenient scapegoat than an actual culprit, economists agreed.

Hypothesis: It’s a result of the mega-mergers across the sector.

“There’s been a lot of consolidation in the health care industry,” says Amitabh Chandra, a health economist at Harvard University, with hospitals banding together to survive the Great Recession, or to maximize their power under the ACA. And that tends to lead to downsizing, as duplicate jobs get eliminated.

RSS Feed

RSS Feed